In today’s digital age, organizations and government agencies are increasingly adopting electronic systems to streamline their operations. One such innovative solution is EOPIS, which stands for Electronic Office Payroll Information System. If you’re curious about what EOPIS is, how it works, and the advantages it offers, this comprehensive guide will provide all the essential information.

What is EOPIS?

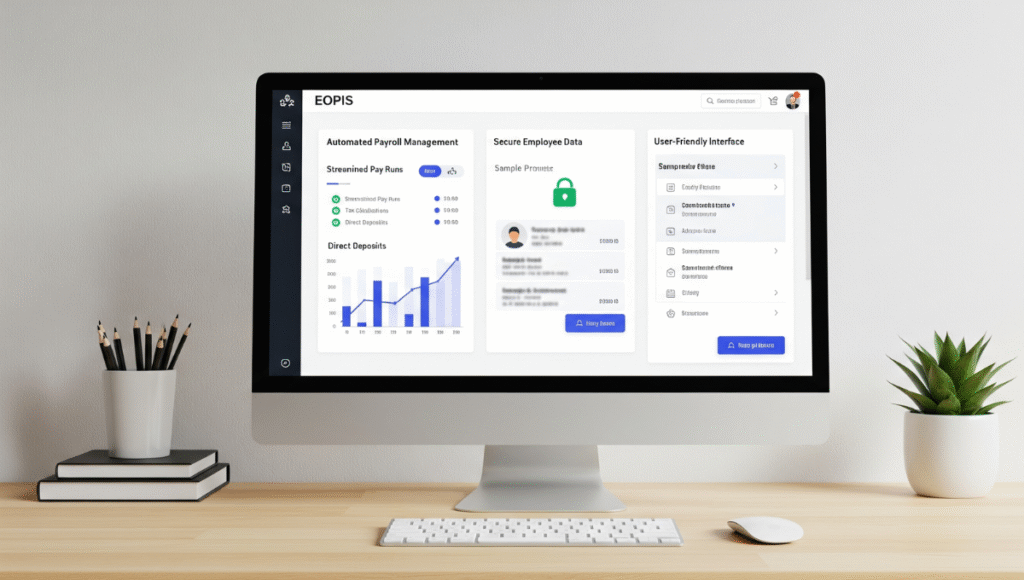

EOPIS, or Electronic Office Payroll Information System, is a digital platform designed to manage payroll and employee information efficiently. It serves as a centralized system that automates payroll calculations, employee data management, and reporting processes. EOPIS is primarily used by government agencies, corporations, and large organizations aiming to improve payroll accuracy, reduce manual work, and ensure transparency.

Unlike traditional paper-based payroll systems, EOPIS leverages technology to store, process, and retrieve payroll data securely and swiftly. It integrates various HR functions, such as attendance tracking, leave management, and salary computation, into a single platform.

Key Features of EOPIS

Understanding the core features of EOPIS helps to appreciate its significance in modern organizational management:

- Automated Payroll Processing

EOPIS automates salary calculations based on attendance, overtime, deductions, allowances, and other variables, minimizing errors and saving time. - Employee Data Management

The system maintains comprehensive records of employee details, including personal information, employment history, tax details, and bank information. - Attendance and Leave Tracking

Integration with attendance systems allows automatic deduction or addition of pay based on hours worked, leaves taken, or absences. - Tax and Deduction Management

EOPIS calculates statutory deductions such as income tax, social security, and other contributions, ensuring compliance with government regulations. - Reporting and Analytics

Generate detailed reports on payroll summaries, tax filings, employee earnings, and deductions for audit and transparency purposes. - Secure Access and Data Privacy

The system offers secure login features with role-based access controls to protect sensitive employee information. - Integration Capabilities

EOPIS can be integrated with other HR and financial systems for seamless data exchange and operational efficiency.

Benefits of Using EOPIS

Implementing EOPIS in an organization offers numerous advantages:

1. Enhanced Accuracy and Reduced Errors

Manual payroll processing is prone to mistakes. EOPIS automates calculations, significantly reducing errors related to salary computation, deductions, and tax filings.

2. Time and Cost Efficiency

Automation speeds up payroll processing, enabling HR and finance teams to focus on strategic tasks rather than administrative chores.

3. Improved Data Security

Sensitive employee data is protected through secure login protocols and encrypted storage, minimizing risks of data breaches.

4. Transparency and Compliance

EOPIS ensures compliance with government payroll regulations and provides transparent records, which are essential during audits and legal compliance checks.

5. Ease of Access and Convenience

Employees and management can access payroll information and reports anytime and anywhere through secure portals.

6. Streamlined HR Processes

Beyond payroll, EOPIS simplifies attendance tracking, leave management, and benefits administration, creating a unified HR ecosystem.

7. Environmental Benefits

Transitioning from paper-based payroll systems reduces paper consumption, supporting organizational sustainability goals.

Who Can Benefit from EOPIS?

EOPIS is especially beneficial for:

- Government agencies and public sector organizations

Due to compliance requirements and large employee bases. - Large corporations and multinational companies

Managing thousands of employees across multiple locations. - Educational institutions and non-profit organizations

Streamlining payroll and HR management. - HR and Finance professionals

Looking for efficient and reliable payroll solutions.

Implementation and Considerations

Adopting EOPIS requires careful planning:

- System Selection: Choose a platform that complies with local regulations and offers necessary features.

- Training: Provide adequate training for HR staff and employees to maximize system utilization.

- Data Migration: Transfer existing employee data securely into the new system.

- Security Measures: Implement robust cybersecurity protocols to protect sensitive information.

- Ongoing Support: Regular updates and technical support are vital for system efficiency.

Conclusion

EOPIS, or Electronic Office Payroll Information System, is transforming the way organizations handle payroll and HR data. Its automation, accuracy, and security features make it an indispensable asset for modern organizations seeking efficiency and compliance.

By understanding its core features and benefits, organizations can make informed decisions to implement EOPIS effectively, leading to streamlined operations, satisfied employees, and improved organizational transparency.

Interested in exploring EOPIS further? Whether you’re a business owner, HR professional, or government official, adopting an EOPIS solution can be a game-changer. Stay informed, choose the right platform, and enjoy the numerous benefits this innovative system offers.

If you’d like more tailored information or assistance with implementation, consult with a professional provider specializing in payroll management systems.

Disclaimer: The specific features and benefits of EOPIS may vary based on the software provider and organizational needs. Always ensure the system you choose complies with local laws and regulations.

For further queries or personalized guidance, feel free to contact us!