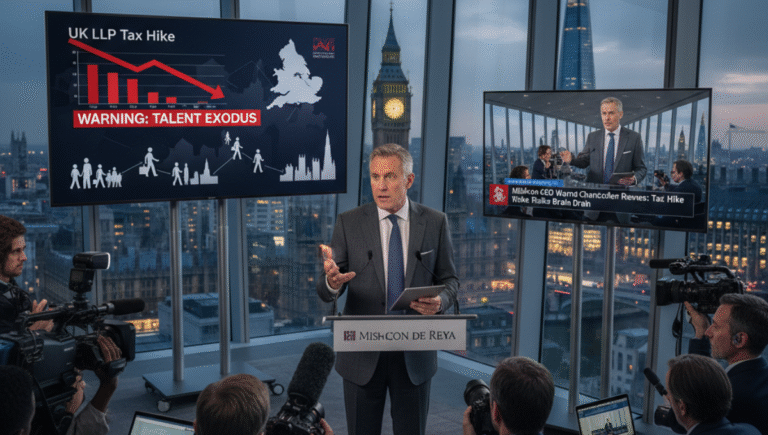

In recent months, the UK legal industry has been closely watching government policy proposals that could shake up the landscape of professional services. Among these, the recent announcement of potential tax hikes on Limited Liability Partnerships (LLPs) has sparked concern, particularly from industry leaders who warn that such measures could have unintended negative consequences. One prominent voice in this debate is the CEO of Mishcon de Reya, who has issued a stark warning to Chancellor Jeremy Reeves: increasing LLP taxes risks causing a mass exodus of top legal professionals from the industry.

The Context: Understanding the LLP Tax Proposal

LLPs are a popular legal structure in the UK, favored by many law firms for their flexibility, liability protections, and tax efficiencies. However, the government’s proposed tax hike aims to increase revenue and fund public services, but critics argue it may undermine the very sector that contributes significantly to the economy.

The proposed changes involve raising taxes on LLPs, which could translate into higher costs for firms and their partners. While the government argues that such measures are necessary for fiscal responsibility, industry insiders fear that these hikes could make the UK legal market less competitive on a global scale.

The Warning from Mishcon’s Leadership

Mishcon de Reya, one of the UK’s leading law firms, has been vocal in its opposition to the proposed tax increases. The firm’s CEO, Kevin Gold, recently issued a warning that the tax hike could lead to an exodus of top talent—experienced lawyers, partners, and professionals—seeking more tax-friendly jurisdictions or alternative career paths.

In his statement, Gold emphasized that “the legal sector is highly competitive and relies heavily on attracting and retaining the best talent. Any move that increases the financial burden on professionals risks destabilizing this ecosystem.” He further explained that top-tier lawyers are often highly mobile and could easily relocate to countries with more favorable tax regimes, such as Ireland, Singapore, or even the United States.

The Impact on the Legal Industry and Economy

The potential departure of experienced professionals could have far-reaching consequences beyond individual firms. It could diminish the UK’s standing as a global legal hub, reduce foreign investment, and slow economic growth. Law firms often serve as strategic partners for multinational corporations, and their ability to attract top talent directly influences the quality of legal services in the UK.

Furthermore, the loss of top professionals could lead to a decline in client confidence, especially among high-net-worth individuals and international businesses who seek legal advice from reputable and experienced firms. This, in turn, could impact employment levels within the sector and reduce contributions to the economy through taxes and associated services.

Industry Response and Advocacy

In response to these concerns, industry associations and legal firms have ramped up advocacy efforts, urging policymakers to reconsider the tax hike. Many argue that a more balanced approach is needed—one that funds public services without jeopardizing the UK’s competitive edge.

Some proposals include targeted tax reforms, incentives for legal firms to expand and innovate, and measures to attract international talent. Law firms are also exploring alternative structures and operational models to mitigate the impact of higher taxes while maintaining their service quality.

The Broader Political Landscape

This issue is also intertwined with broader political debates about taxation, economic competitiveness, and public expenditure. The government faces a delicate balancing act: raising revenue to support public services while ensuring that the UK’s legal and professional sectors remain vibrant and attractive for talent.

Reeves and his team are under pressure to justify the tax hike, with opposition parties and industry leaders warning of the potential fallout. The upcoming legislative sessions are expected to be pivotal in determining the final shape of the tax reforms.

Conclusion: A Call for Thoughtful Policy-Making

The warning from Mishcon’s leadership underscores a vital point: policy decisions in the legal sector—and in any industry—must be made with a comprehensive understanding of their ripple effects. While funding public services is essential, it should not come at the expense of the industry’s long-term health and competitiveness.

As the debate continues, industry stakeholders hope for a collaborative approach that balances fiscal responsibility with the need to retain top talent and sustain the UK’s position as a global legal leader. The message from Mishcon de Reya is clear: without careful consideration, the proposed LLP tax increase risks doing more harm than good, potentially driving away the professionals who are the backbone of the UK’s legal excellence.